Policy Clarifications Cash Assistance - All - PCA16745150 Medicaid - Long Term Care - PMN16745350 SNAP - PFS16745550

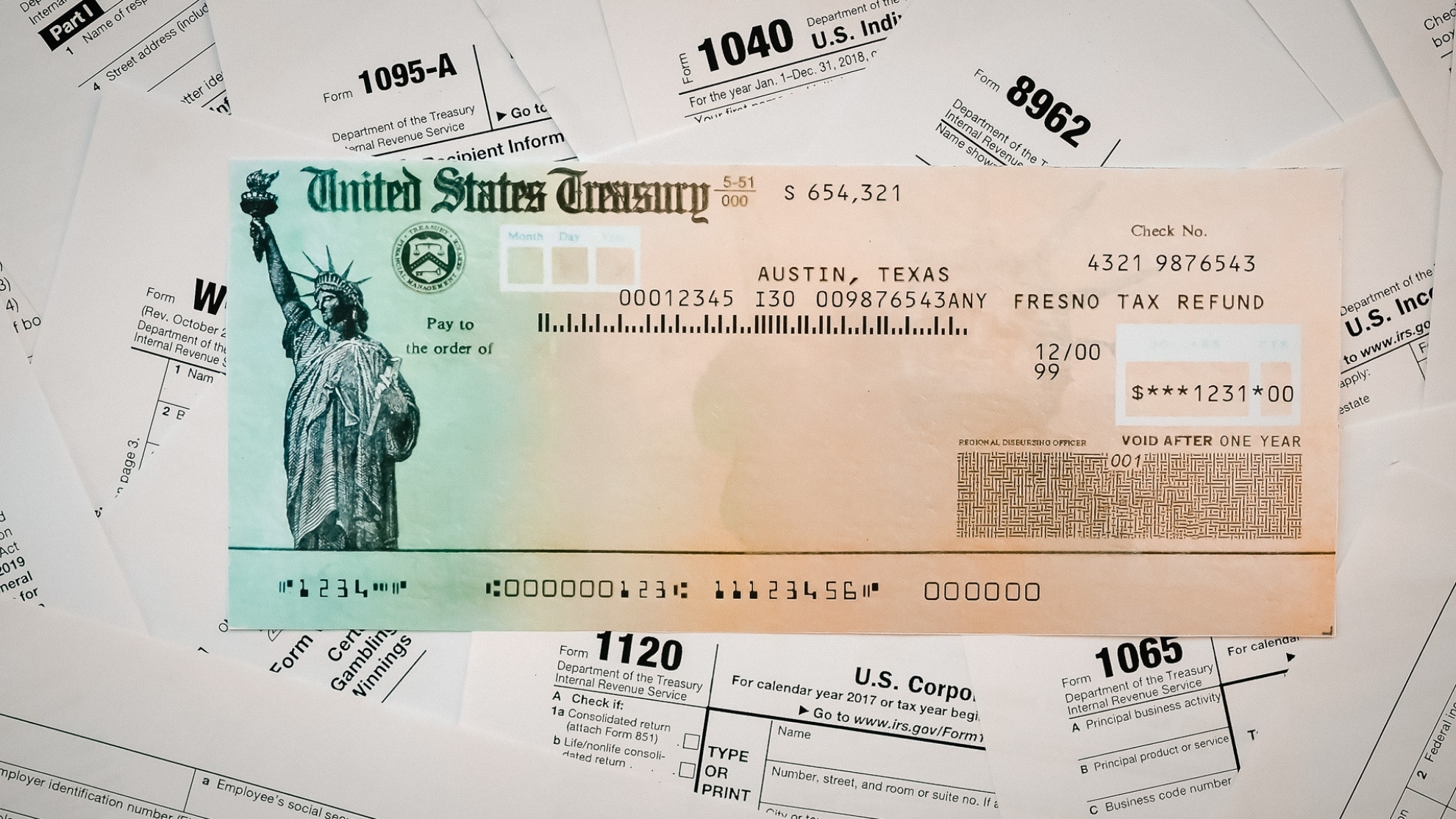

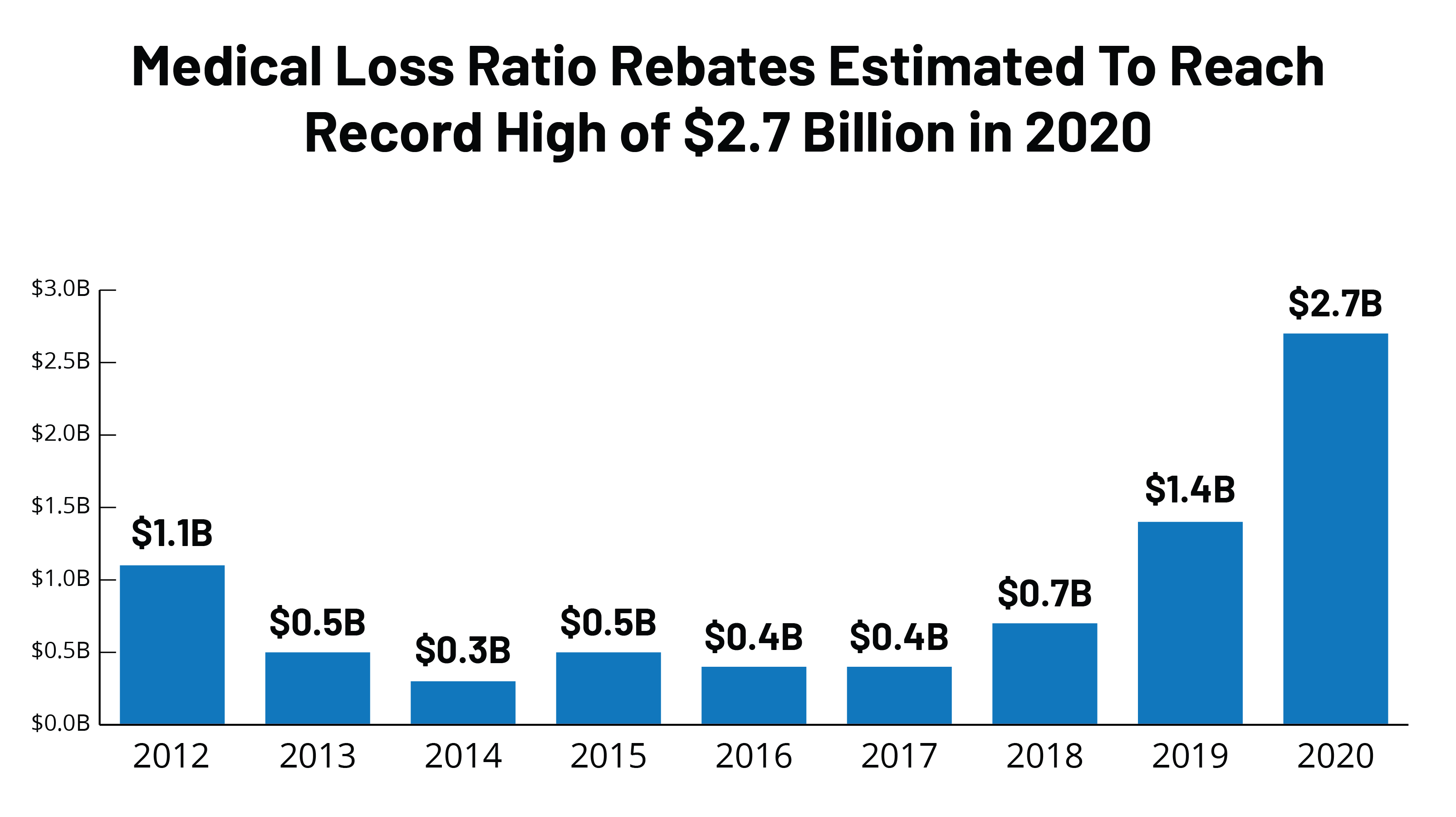

One-time lump sum payment going out over the next nine days from $3billion pot - see the eligibility criteria | The US Sun

One-time lump sum payment going out over the next nine days from $3billion pot - see the eligibility criteria | The US Sun

One-time lump sum payment going out over the next nine days from $3billion pot - see the eligibility criteria | The US Sun

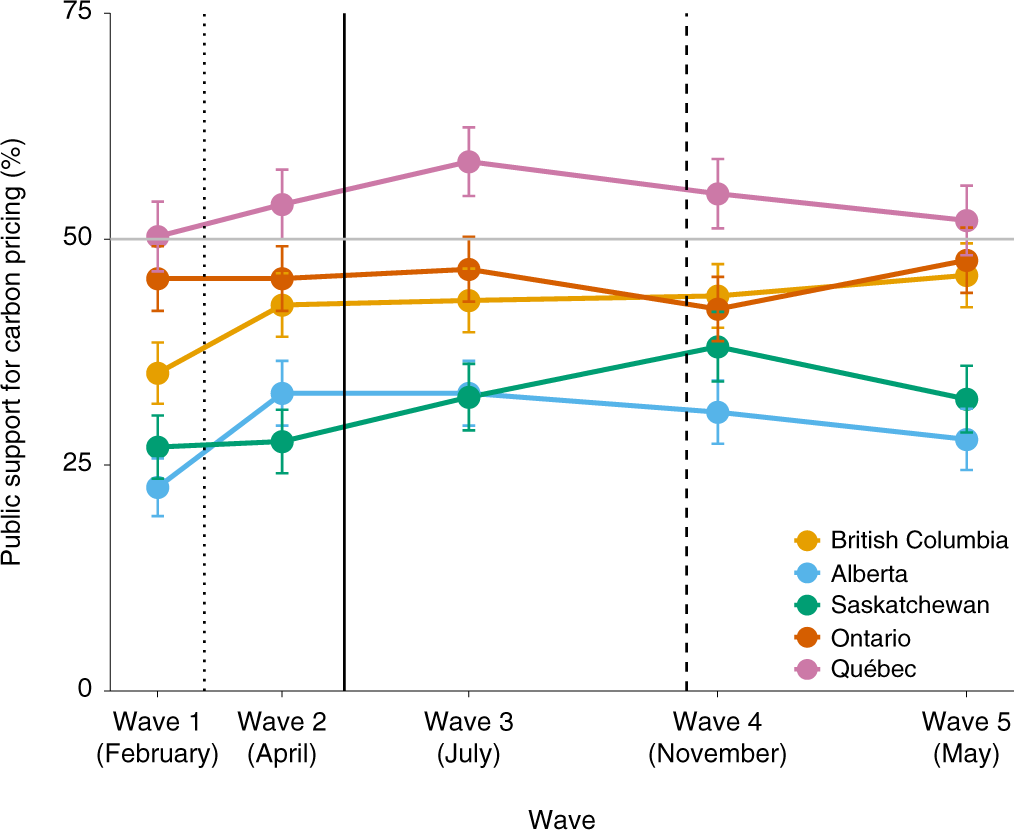

Limited impacts of carbon tax rebate programmes on public support for carbon pricing | Nature Climate Change

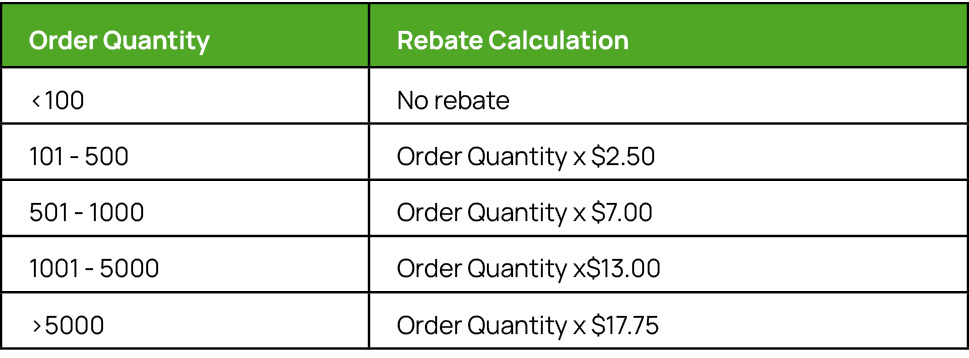

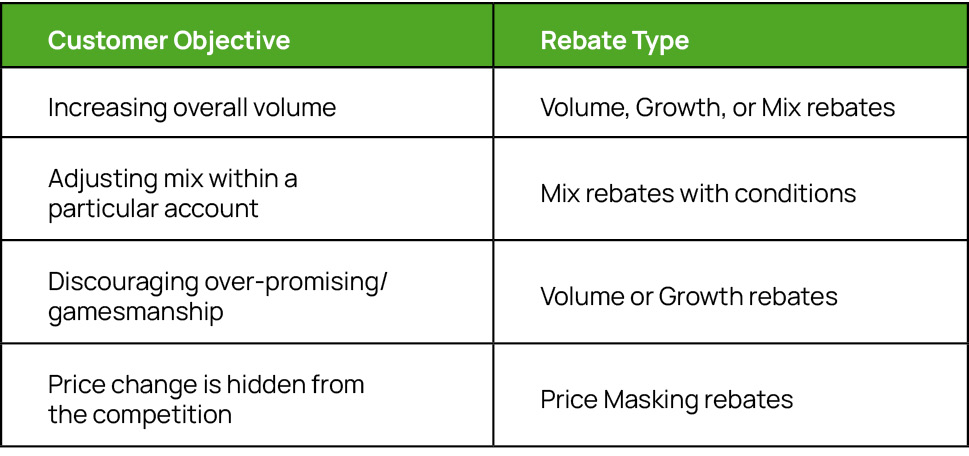

Trade Allowance Management Blog Series – Trade Allowance Agreements for Bill Back - Microsoft Dynamics 365 Blog

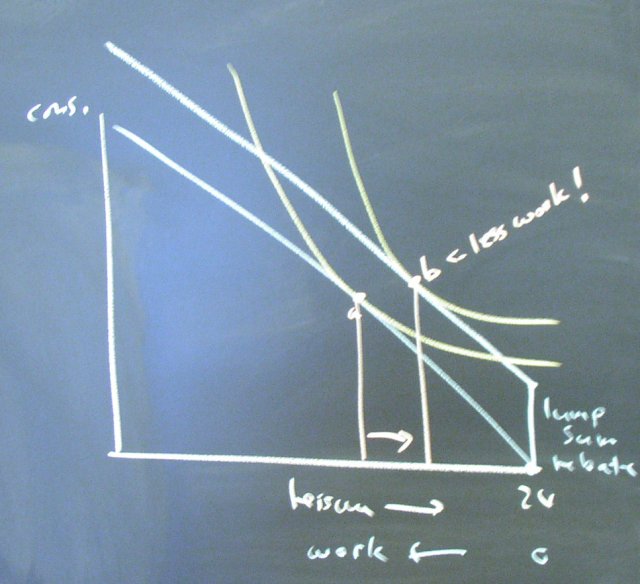

FAQ-- HEARING OFFICERS PER SESSION HEALTHCARE REBATE 2021 What is the Healthcare Rebate? How and when will the rebate be paid? W